Cash & profitability are the name of the game

Working capital reduction – and financing – are the most important management activity and challenge for mid-sized and large companies because of their significant financial impact on cash, performance and growth.

The old saying ‘Cash is King’ is all the more relevant with the current global economic conditions, where access to cash has become ever more challenging and expensive. This further increases the need of companies to focus on finding, delivering and sustaining cash and profit from working capital.

Effective and disciplined working capital management can indeed release significant and sustainable cash flow from working capital. Cash that will leverage the three major drivers for financial performance: profitability, capital utilization, and growth

All of which improve performance, increase company value and shareholder returns, and create a competitive advantage.

Hence, while working capital analysis and optimization has become a major determinant of the long-term growth and sustainability of companies, freeing up this capital is no easy task. This is exactly why, and this is exactly what we labor to achieve for our clients.

Leading companies are using working capital management as a key lever for building liquidity and minimizing related business risk across their supply chain base

Working capital consumes cash and increases capital requirement

KNOW MORE

Working capital is the total amount of money invested in the operating cycle of the company. As such, working capital consumes cash and increases capital requirement.

Working capital finances the Cash Conversion Cycle (CCC) of a business also called Cash-to-Cash Cycle.

The CCC is the time duration in which a company is able to convert its resources into cash – that is, the total time required to convert resources into inventories first; then to convert inventories into finished goods; next to convert finished goods into sales; and finally, to convert sales into cash.

This is why leading companies are finding ways to collapse the time in their Cash Conversion Cycle.

CCC calculation explained:

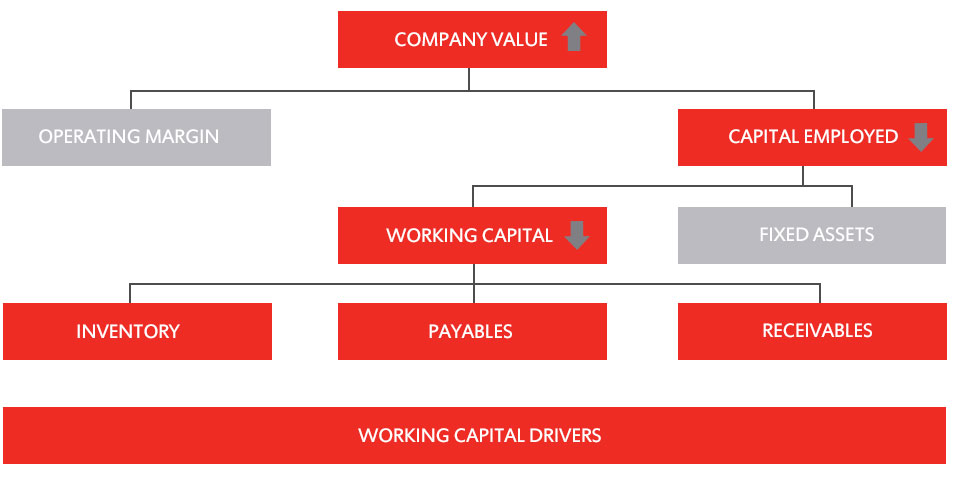

Working capital is a key driver to build liquidity, improve bottom line results and increase company value

KNOW MORE

Effective and disciplined working capital management can release significant and sustainable cash flow from working capital. Cash that will leverage the three major drivers for financial performance: profitability, capital utilisation, and growth

All of which improve performance, increase company value and shareholder returns, and create a competitive advantage.

Working Capital Optimization = ↑ Cash + ↑ Owners’ Equity

5 to 10% of companies’ annual sales are unnecessarily tied up in their working capital

KNOW MORE

Some recent studies have estimated that 5 to 10% of companies’ annual sales are unnecessarily tied up in their working capital. This aggregate amount of cash unnecessarily tied up in the working capital of the leading 2,000 US and European companies has been estimated to amount to US$1.4 trillion.

Therefore, companies are striving to free up the internal cash trapped within their different working capital components. Rather than relying on external bank financing, we are seeing savvy companies targeting working capital reductions to unlock and accelerate cash invested in the business.

After all, the cheapest source of capital is cash that is released from working capital.